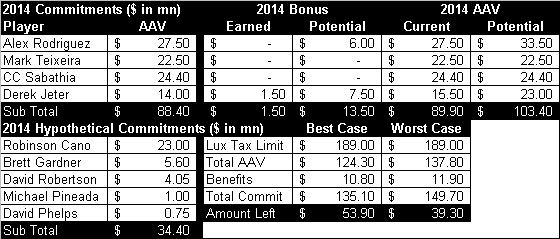

As the off season draws on, it’s becoming increasingly clear that the Yankees are operating under self-imposed fiscal restraints. As a result, examining the team’s 2014 commitments has become a required part of analyzing Brian Cashman’s blueprint for this winter. However, there are several variables that are hard to quantify, not the least of which is Derek Jeter’s intentions for next season.

When the Yankees signed Jeter to a four year deal, the player option for 2014 was looked upon as a formality. Considering the aging short stop was already in an apparent decline, it seemed unlikely that he would be in a position to exercise the buyout. Following a resurgent season in which Jeter won the silver slugger, that eventuality has now become a distinct possibility.

If Derek Jeter has a phenomenal season in 2013 and hits all of his performance incentives, his 2014 salary would jump from $9.5 million to $17 million, increasing his AAV all the way to $23 million. Although that would auger well for 2013, it could have dire consequences for the team’s budget in 2014. This ironic circumstance illustrates the delicate balance the Yankees face in shifting from Mission-28 to Mission-$189 million.

Although a career year from Jeter seems like an ironic worst case scenario for the 2014 budget, another event could have an even more negative impact: Jeter deciding to opt out. By virtue of his silver slugger award in 2012, the short stop’s salary for 2014 is currently $9.5 million. However, he also has a $3 million buyout, effectively making his player option worth only $6.5 million. Assuming he doesn’t hit any more contractual bonuses, Jeter could be put in a position where opting out makes the most sense (and cents).

Derek Jeter’s Potential AAV in 2014 ($mn)

| Scenario Analysis | 2011 | 2012 | 2013 | 2014 | AAV |

| Current Contract | $ 15.00 | $16.00 | $17.00 | $ 8.00 | $14.00 |

| If Jeter Takes Buyout | $ 15.00 | $16.00 | $17.00 | $ 3.00 | $17.00 |

| If Jeter Exercises (Current Salary) | $ 15.00 | $16.00 | $17.00 | $ 9.50 | $15.50 |

| If Jeter Exercises (Max Salary) | $ 15.00 | $15.00 | $15.00 | $17.00 | $23.00 |

Note: Jeter has a $3 million buyout for 2014. He has already earned a $1.5 million bonus payable in 2014. If Jeter takes buyout, calculated AAV would be used to determine luxury tax underpayment from 2011-2013.

Source: salaries from Cots Contracts